When people are thinking of buying a franchise, one question they usually ask is “How much money can I make?” But, the answer is, “it depends”. It depends on how good they are at running it.

When people are thinking of buying a franchise, one question they usually ask is “How much money can I make?” But, the answer is, “it depends”. It depends on how good they are at running it.

But that’s not very helpful when it comes to deciding whether to buy a franchise or not. We all need money to pay the bills, so you need to get an idea of whether you can make a decent living from the franchise you’re considering.

When it comes to finding a profitable franchise opportunity you should definitely examine the franchisor’s track record and check if the existing franchisees are making money. But how do you get an idea of how much you can make?

The answer is to do some financial projections. This will give you an idea of the income and the costs of running the business you are looking at. Then you’ll see whether it is likely to generate enough profit to give you the income you need.

5 steps to work out how much profit your franchise can make

Here are five steps that will help you work out how much profit your franchise can make, and give you the best chance of achieving it.

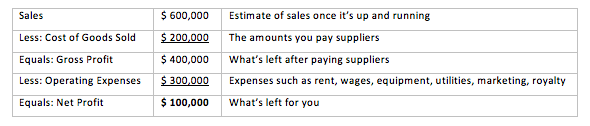

1. Assess the potential of the business. Before you spend any money on advisers and ‘experts’ it’s a good idea to do a ‘back of the envelope’ estimate of how much profit the business could make. Let’s look at a simple example.

In practice, there’s more to consider when it comes to assessing the financial potential of a business. But this exercise will give you an idea of the profit you can make once your business is established.

If you are happy with how things look it’s worth doing a more thorough assessment. At this next stage you’ll use more detailed financial information to get a better understanding of how much you could make from the business.

2. Prepare detailed financial projections

If your initial assessment looks promising the next step is to dig deeper into the numbers. This is where you prepare detailed projections based on information you’ll get about the likely sales and each of the operating costs of the business. These projections are much more detailed than the example above. The franchisor may have a format you can use, or you can ask your accountant.

It’s important to do this step because as the business owner you need to understand how the business works financially. Yes, you! Don’t neglect this, even if you think you’re not very good with numbers. You can ask an accountant to help put the figures together once you’ve collected the information.

So, where do you get the figures for sales and costs?

For a brand new franchise, a good place to start is the Disclosure Document. This is where you will find details of the main costs to operate your franchise. The Disclosure Document may also include details of the franchise performance benchmarks, and sales and expense figures for existing franchises.

If you are looking to buy an existing franchise, you will be able to see the figures from the previous owner.

Other franchisees in the group are also a great source of help at this stage, so be sure to ask for their comments about sales and costs in their business. It’s a good idea to speak with successful owners and also those who have struggled at some point. This will help you get a balanced understanding of the business.

Once you’ve gathered this information, put your projections together. Be sure to take into account your specific costs, such as rent, wages, loan payments and other financial commitments. With regard to sales, be sure to allow for realistic growth and seasonal sales patterns.

You should also take time to meet with an accountant who has experience with franchises. They can assist you in putting your projections together.

3. Work out how much you could pay yourself

How much you pay yourself really comes down to what the business can afford. Your financial projections will help you see this for yourself. After you’ve paid all the day-to-day bills, and your bank loan repayments, you will see how much is left. That’s what’s available for you.

But remember, apart from your wages, you need to allow for reinvestment to support growth of the business. You will also need to repay yourself for any money you’ve put into the business.

4. Assess the results

Now that you’ve done the numbers, it’s time to step back and assess the result. Do the projections show this business can make a healthy profit? Based on your research of the franchise, are the projections achievable? Will this franchise give you the income you need?

5. Make it happen

So far, what you’ve prepared are projections, and they’re just on paper. To make money, you’ve got to turn these into reality!

Once you can see that the business has potential, you’ll need to determine how to achieve it.

There are two key parts to this. Firstly, work with the franchisor and understand how their systems, advice and support will help you get started and then run the business effectively. Secondly, start putting your own plans together for how you will attract customers, manage costs and run a profitable business.

You see, it takes more than a proven franchise and good intentions to succeed. It doesn’t just happen by itself. To turn your projections into reality you’ll need to make a plan, then follow that plan to make your financial goals come true.

In the next article in this series we’ll be discussing how to prepare a business plan, and the steps you need to follow to run an effective business.

About us

This is a guest post by Peter Knight, FCPA and Kate Groom. Through their business, Smart Franchise, they help franchise owners understand the financial side of business.

Peter is an accountant with over 25 years in professional practice advising business owners. Kate has worked with franchises for almost 20 years, focusing on business improvement. She was formerly Business Performance Manager with Kwik Kopy Australia.

Find out more at www.smartfranchise.com.au